News

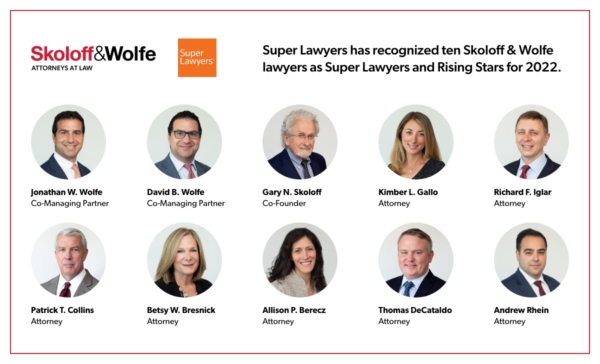

7 Skoloff & Wolfe, P.C. Attorneys Named 2024 New Jersey “Super Lawyers”

Jonathan Wolfe was a speaker at NJICLE's 2022 Family Law Summer Institute on the topic of "Discovery of Experts."

David Wolfe was a guest panelist at BisNow’s New Jersey Life Sciences Biotech Conference on July 14th.

David B. Wolfe, Esq. moderated the Amenities Panel at the Jersey City Summit – for Real Estate Investment.

Jonathan Wolfe, Esq. presented at the 34th Annual ABA RPTE National CLE Conference on the topic of, "Planning for Divorce: What Every Estate Planner Needs to Know."

Jonathan Wolfe, Esq. was invited to speak at the Family Office Institute.

David Wolfe, Esq. presented at NJSBA's webinar about real estate tax appeals in 2022.

Jonathan Wolfe, Esq. presented at the NYSBA Trusts and Estates Law Section Fall 2021 Meeting on the topic: "Trust Assets in Divorce: Fair Game or Off Limits?"

Jonathan Wolfe Presents at the NYSBA Trusts And Estates Law Section Fall 2021 Meeting

Jonathan Wolfe, Managing partner of Skoloff & Wolfe, presented at the New York State Bar Association on the topic: “Trust Assets in Divorce: Fair Game or Off Limits?”

Judge David J. Issenman (ret.) presented "Lincoln's Ethical Quandary: Order #11 and The Burning of Western Missouri" for the New Jersey Chapter of the American Academy of Matrimonial Lawyers (AAML)

Richard F. Iglar Moderated Seminar on Biden's First 100 Days for the AAML

Richard F. Iglar, Partner at Skoloff & Wolfe, moderated “Biden’s First 100 Days: The Impact on Your Client’s Bottom Line” by Financial Research Associates and Withum for the New Jersey Chapter of the American Academy of Matrimonial Lawyers (AAML).

David Wolfe, Managing Partner at Skoloff & Wolfe, P.C. was a featured speaker at an AAHOA webinar on the topic of Property Tax Appeals for Hotels

Beatrice Kandell and Thomas DeCataldo Lectured at NJ Bar Association's Hot Tips in Family Law Seminar

Skoloff and Wolfe, P.C. partners Beatrice Kandell, Esq. and Thomas DeCataldo, Esq. spoke at the New Jersey State Bar Association’s annual Hot Tips in Family Law Seminar. Ms. Kandell and Mr. DeCataldo joined a distinguished panel addressing a virtual audience of over 100 attendees, which included family lawyers, expert witnesses, and matrimonial judges.

Richard F. Iglar, Partner at Skoloff & Wolfe, presented "Ethics in Family Law," for NJ ICLE's "Matrimonial Certification Prep Course"

Richard F. Iglar Moderated AAML Seminar on COVID-19 Impact

Richard F. Iglar, Partner at Skoloff & Wolfe, P.C., moderated “Business Valuation in Times of Uncertainty: Impact of COVID-19,” by Financial Research Associates for the New Jersey Chapter of the American Academy of Matrimonial Lawyers (AAML).

David Wolfe Featured in Times of Entrepreneurship Publication

David Wolfe, Managing Partner at Skoloff & Wolfe, was featured in the Times of Entrepreneurship article, “Rent May Be The Final Blow For Struggling Small Businesses.”

Bea Kandell, Attorney at Skoloff & Wolfe, P.C., will be moderating a program for Inn of Court on "The Responsibility for Payment of College Expenses"

Beatrice Kandell Announced as Panelist for Upcoming ECBA Webinar

Bea Kandell, Attorney at Skoloff & Wolfe, will be a panelist on the upcoming ECBA webinar “Divorce, Finances and COVID-19: Moving Matrimonial Cases Forward During a Global Epidemic.”

Jonathan Wolfe Moderated AMA Panel on Post-COVID Finance

Jonathan Wolfe, Managing Partner at Skoloff & Wolfe will be moderating a panel discussion for the ABA, “The Other Side of the Coin: Financial Issues In a Post-COVID World.”

Richard F. Iglar Became President of the AAML, NJ Chapter

Richard F. Iglar, Partner at Skoloff & Wolfe, P.C., was installed as President of the New Jersey Chapter of the American Academy of Matrimonial Lawyers (AAML).

David Wolfe Served as Panelist on CAPRE Webinar Series

David Wolfe, Managing Partner at Skoloff & Wolfe, P.C., was a panelist on CAPRE’s NJ CRE Webinar Series on New Jersey’s commercial real estate industries response to COVID-19 and outlook for the rest of 2020.

David Wolfe was featured in Bisnow's article, "New Jersey Developers Increasingly Threatened By Property Tax Lawsuits"

David Wolfe joined the "Office Financing and Investment Strategy" panel at Bisnow's Office & Workplace of the Future event

David Wolfe and Saul Wolfe led New Jersey Institute for Continuing Legal Education's lecture on "Navigating a Real Estate Tax Appeal in 2020"

Jonathan Wolfe Spoke at NJ Family Law Symposium

New Brunswick, NJ – Jonathan Wolfe was a speaker for “Trusts and Equitable Distribution” at the 2020 New Jersey Family Law Symposium, a leading annual family law conference, presented by the New Jersey Institute for Continuing Legal Education and the New Jersey State Bar Association.

David Wolfe Served on Bisnow Summit Panel

New York, NY – David Wolfe joined the “Remaining Competitive in a Tourist Hub” panel at Bisnow’s Hospitality Investment, Development & Management Summit.

David Wolfe Moderated Panel at Bisnow Multifamily Summit

Livingston, NJ – David Wolfe moderated a panel at Bisnow: NJ Multifamily Summit, leading discussion on how New Jersey can maintain a competitive advantage over NY-Metro neighborhoods.

Jonathan Wolfe was sworn in as Chair of the American Bar Association Family Law Section in San Francisco

The Skoloff & Wolfe, P.C. Bocce Team participated in the Essex County Bar Association's annual bocce event

Although the team was unable to defend its 2018 title, an enjoyable time was had by all.

Kimber Gallo was installed as the Treasurer of the Summit Bar Association

David Wolfe Participated in Professional Real Estate Panel

Jersey City, NJ – David Wolfe participated in a panel of experienced Real Estate professionals to analyze Northern New Jersey and Gold Coast development, investment and leasing outlook. The discussion focused on pockets of growth, popular/emerging submarkets, and demographic trends.

David Wolfe Moderated a Panel CAPRE's Newark CRE Summit

Newark, NJ – David Wolfe lead panelists in a conversation on “The Retail Renaissance & Newark Resurgence,” focusing on what is currently drawing new tenants into Newark and the growth of service-oriented retail.

Richard Iglar was sworn in as President-Elect at the New Jersey Chapter of the American Academy of Matrimonial Lawyers Annual Dinner Dance

Gary Skoloff Spoke at NJSBA Senior Lawyers Conference

Gary Skoloff was a Moderator/Speaker at the 2019 NJSBA Senior Lawyers’ Conference providing attendees with strategies leading to happiness, health, and a more enjoyable final chapter in their careers.

David Wolfe moderated a panel on “Value-Add Investments in New Jersey” at Bisnow's Repositioning Summit

Richard Iglar Lectured at AAML Annual Seminar

Rick Iglar lectured on the topic of “Taxes and Divorce in 2019 and Beyond” for the AAML New Jersey Chapter’s Annual Seminar at the New Jersey Law Center in New Brunswick.

Hon. David J. Issenman, JSC (ret.) lectured on the topic of Leading Questions at the New Jersey State Bar Family Law Retreat in Aruba

Skoloff & Wolfe, P.C. Secures Kean University's Property Tax Exemption

Trenton, NJ – Skoloff & Wolfe, P.C. successfully represented Kean University at the Appellate Division. Finding they qualified for a property tax exemption, the Appellate Division ruled that a restaurant on campus constitutes a university purpose. Results may vary depending on your particular facts and legal circumstances.

Richard Iglar Named Follow of the IAFL

Richard Iglar was named a Fellow of the International Academy of Family Lawyers (IAFL). IAFL is a worldwide association of practicing lawyers who are recognized by their peers as the most experienced and skilled family law specialists in their respective countries.

Richard Iglar and Thomas DeCataldo Participated in Harvard Law School Family Law Seminar

Skoloff & Wolfe, P.C. attorneys, Richard Iglar and Thomas DeCataldo, participated in the Harvard Law School 2019 Negotiation Seminar for Family Law Lawyers designed for experts in family law.

David Wolfe Lectured at BisNow State of the Market

Jersey City, NJ – David Wolfe was joined by leading investors and developers to lecture on “Industrial & Logistics Outlook 2019” at BisNow New Jersey 2019 State of the Market.

Saul Wolfe and David Wolfe led New Jersey Institute for Continuing Legal Education lecture on “Real Estate Tax Appeals: Update 2019”

David Wolfe Spoke on Jersey City Revaluation at Summit

Jersey City, NJ – David Wolfe provided update on the status of the Jersey City revaluation, significant takeaways, and future implications to over 800 attendees at the 4th Annual Jersey City Summit for Real Estate Investment.