Respected, Effective, Innovative

Skoloff & Wolfe, P.C. is well-versed in the area of property tax law. The Tax Department has litigated the value of virtually every type of commercial, industrial and multi-family property. Our attorneys also frequently counsel clients regarding property tax exemption matters and long-term abatements and PILOTs. S&W clients include developers, management companies, financial institutions, REITs, hospitals, universities, religious institutions, private equity firms, and insurance companies.

The Department is proud to have assisted clients in the development and stabilization of several of the transformational projects in New Jersey’s largest two cities, Jersey City and Newark. In addition to assisting clients in every county in New Jersey, S&W attorneys assist clients throughout the North East and Mid-Atlantic regions. S&W also handles significant matters nationally through its relationship with the National Association of Property Tax Attorneys (NAPTA).

Skoloff & Wolfe, P.C. has a proven record of results. In recent years, we have obtained billions of dollars in assessment reductions for our clients, including the following assessment reductions:

- Reduced hotel assessment from $421 million to $259 million

- Reduced office assessment from $372 million to $264 million

- Reduced multi-family assessment from $116 million to $67 million

- Reduced hotel assessment from $189 million to $131 million

- Reduced office assessment from $138 million to $64 million

- Reduced multifamily portfolio from $146 million to $93 million

- Reduced super-regional mall assessment from $21 million to $9 million

- Reduced nursing home assessment from $36 million to $10 million

- Reduced power center assessment from $21 million to $13 million*

* All assessments rounded to nearest million. Results may vary depending on your particular facts and legal circumstances.

The Department’s attorneys include two Board Members of the National Association of Property Tax Attorneys, the current and past Chair of the Taxation Section of the New Jersey State Bar Association (NJSBA), the former Assessor of the City of Newark, and three current or former Chairs of the NJSBA Real Property Tax Practice Committee.

Sought after as speakers in the field, our attorneys have been selected as New Jersey Super Lawyers, named Top New Jersey Real Estate Attorneys by Real Estate New Jersey, and have been quoted or featured in GlobeStreet.com, Forbes.com, Marketwatch.com, The Star-Ledger, NJBIZ, Real Estate New Jersey, and Commerce Magazine.

Please note that no aspect of advertisements or any other accolade listed have been approved by the Supreme Court of New Jersey. Learn more about the standard methodology for each award listed.

THE SILENT KILLER: What New Jersey Attorneys Need to Know About Chapter 91

David Wolfe provides helpful information on the Chapter 91 statute.

Commercial Property Tax Appeals in New Jersey

David Wolfe provides insights on Commercial Property Tax Appeals in New Jersey.

What do New Jersey Property Owners Need to Know about Assessor's Requests for Income and Expense Information?

David Wolfe shares his insights in Mid Atlantic Real Estate Journal.

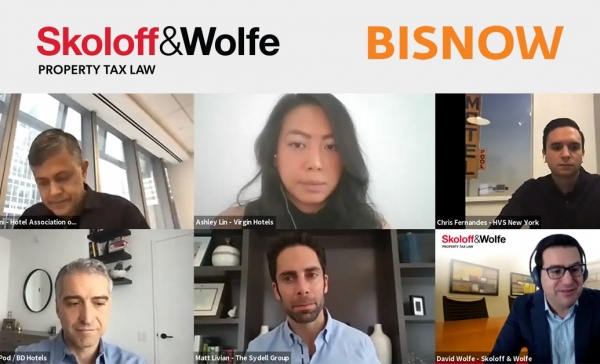

Hotel Property Tax

In today’s hyper-competitive hospitality market, hotel owners need to look for every opportunity to save on expenses while maintaining their five-star service.

New Jersey Office Property Tax

We specialize in data-driven property tax appeal representation and analysis that restores and enhances value to commercial office properties. We also assist prospective buyers and developers in effectively underwriting the potential property tax burden associated with the acquisition or development of office properties.

Multifamily Property Tax

Property tax appeals are one area where a data-driven approach can lower costs and increase the value of multifamily real estate holdings, particularly in times of unusual revenue pressure. A property tax appeal, guided by an experienced attorney, can significantly enhance net operating income and maximize a property’s value in the near and long-term.

Property Tax Underwriting and Due Diligence

Skoloff & Wolfe, P.C.’s property tax due diligence team works closely with our clients so that they can make informed investment and underwriting decisions. Skoloff & Wolfe, P.C. assists clients on projecting and understanding taxes from acquisition through stabilization and disposition.

Industrial Property Tax Appeals

Industrial property has been one of the best performing property classes, making it a target for municipalities and taxing authorities seeking to raise assessments and increase taxes.

Retail Property Tax

Retail property investors, owners, and tenants need experienced representation working on their behalf to battle back local property tax hikes. Skoloff & Wolfe, P.C. provides effective legal counsel backed by in-depth analysis and concrete data points that represent your interests.