Real Estate NJ, the commercial real estate voice of New Jersey, recently featured Skoloff & Wolfe, P.C. (S&W) in its “NJ’s Best Property Tax Appeal Law Firms” list. Please note that no aspect of advertisements or any other accolade listed have been approved by the Supreme Court of New Jersey. Learn more about the standard methodology for each award listed.

Real Estate NJ, the commercial real estate voice of New Jersey, recently featured Skoloff & Wolfe, P.C. (S&W) in its “NJ’s Best Property Tax Appeal Law Firms” list. Please note that no aspect of advertisements or any other accolade listed have been approved by the Supreme Court of New Jersey. Learn more about the standard methodology for each award listed.

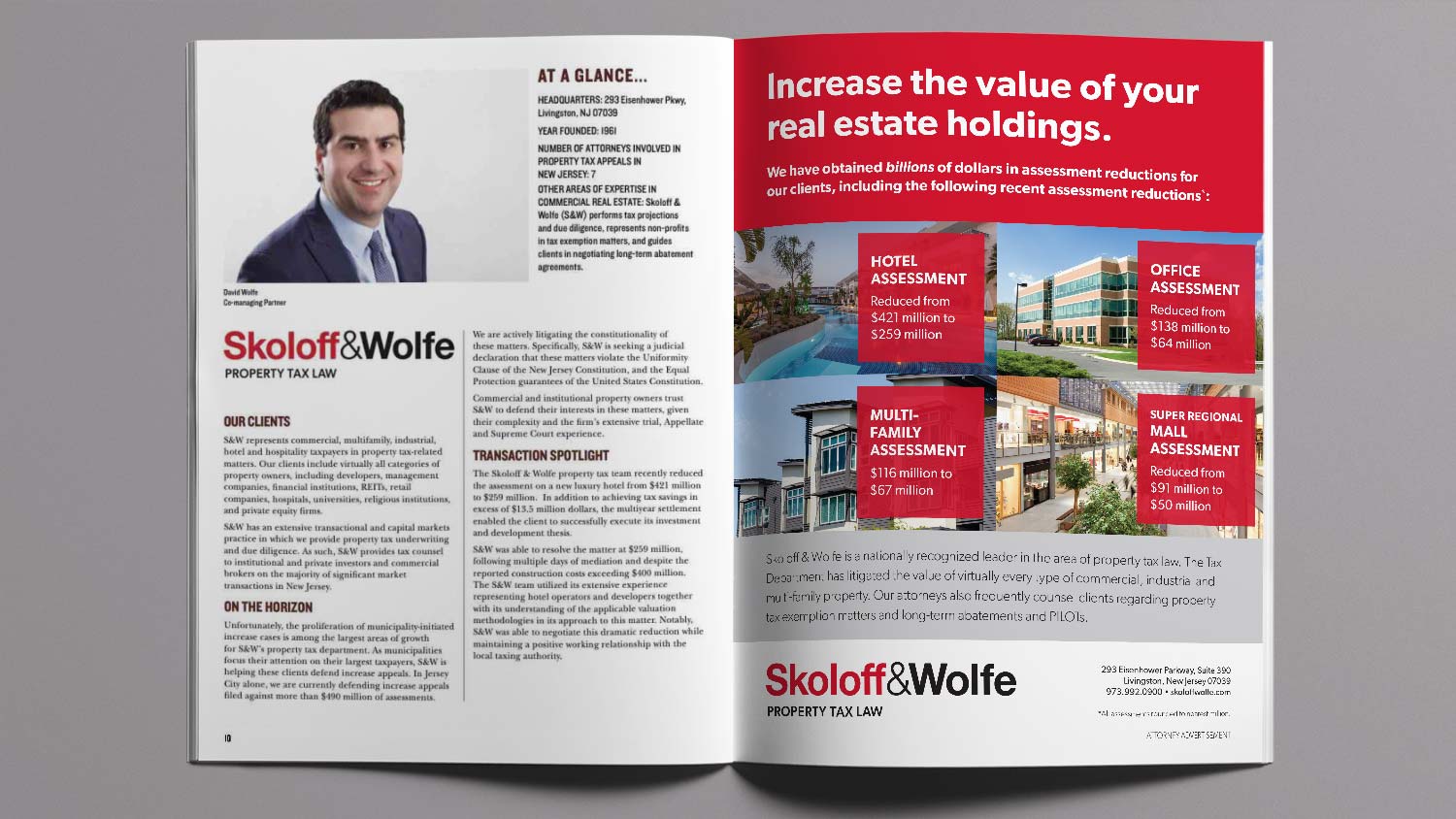

One of five firms included in the publication’s Professional Spotlight 2020, S&W represents commercial, multifamily, industrial, hotel and hospitality taxpayers in property tax related matters. Its clients include virtually all categories of property owners, including developers, management companies, financial institutions, REITs, retail companies, hospitals, universities, religious institutions, and private equity firms.

Property Tax Increase Cases a Looming Threat for Commercial Property Owners

The proliferation of municipality-initiated increase cases is among the largest areas of concern for commercial property tax payers. As municipalities focus their attention on their largest taxpayers, S&W is helping these clients defend increase appeals. In Jersey City alone, the firm is currently defending increase appeals filed against more than $490 million of assessments.

Furthermore, S&W is actively litigating the constitutionality of these matters by seeking a judicial declaration that these matters violate the Uniformity Clause of the New Jersey Constitution, and the Equal Protection guarantees of the United States Constitution.

Experienced, Effective Legal Representation for Commercial Real Estate Clients

In addition to taking charge in property tax appeal litigation, S&W’s other areas of expertise in real estate include performing tax projections and due diligence, representing non-profits in tax exemption matters, and guiding clients in negotiating long-term abatement agreements.

S&W has an extensive transactional and capital markets practice in which it provides property tax underwriting and due diligence. As such, S&W provides tax counsel to institutional and private investors and commercial brokers on the majority of significant market transactions in New Jersey. That’s why commercial and institutional property owners trust S&W to defend their interests in these matters, given their complexity and the firm’s extensive trial, Appellate and Supreme Court experience.

Helping Commercial Clients Reduce Property Taxes and Save Money

S&W’s record of performance has helped its clients obtain billions of dollars in assessment reductions in recent years. Among these, after multiple days of mediation and despite the reported construction costs exceeding $400 million, S&W was able to reduce the assessment on a new luxury hotel from $421 million to $259 million. In addition to achieving tax savings in excess of $13.5 million dollars, the multiyear settlement enabled the client to successfully execute its investment and development thesis.*

The S&W team utilized its extensive experience representing hotel operators and developers together with its understanding of the applicable valuation methodologies in its approach to this matter. Notably, S&W was able to negotiate this dramatic reduction while maintaining a positive working relationship with the local taxing authority.

Does a property tax appeal make sense for your real estate holdings?

The best way to approach a property tax appeal is to contact Skoloff & Wolfe, P.C. and speak to an experienced property tax attorney. S&W can help you ascertain the chances for a successful appeal. Call today (973) 992-0900.

*Client results may vary depending on particular facts and legal circumstances.