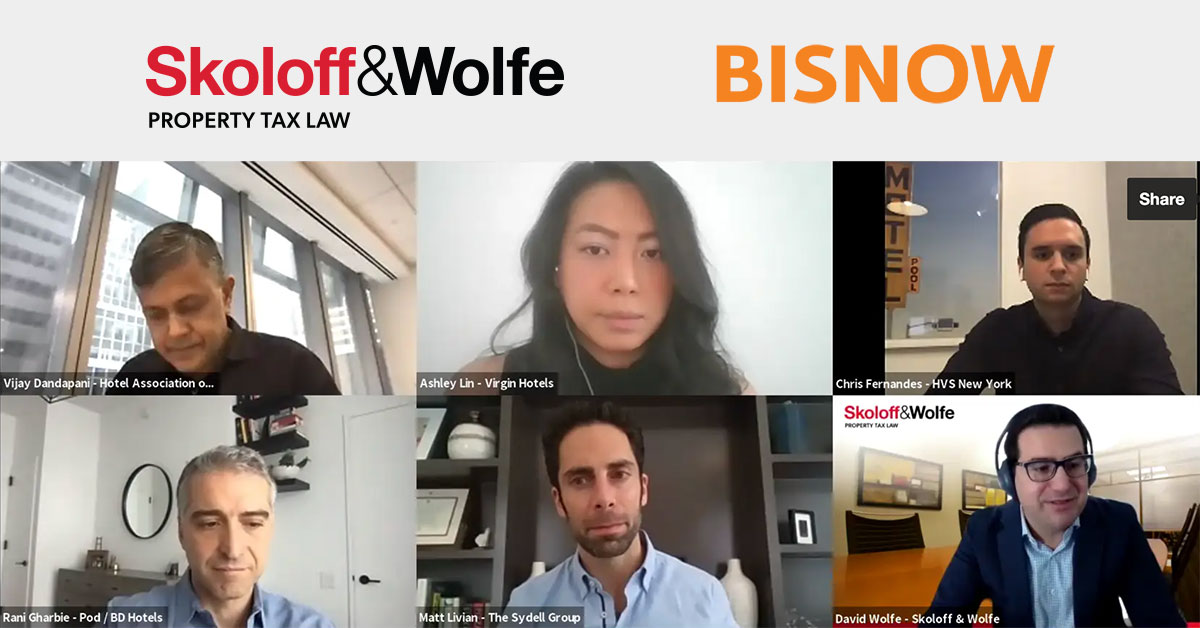

David Wolfe, Esq., co-managing partner of Skoloff & Wolfe, P.C., in February hosted six leaders in the hospitality space for a discussion about the current state of affairs in the hotel business in the age of COVID, and importantly what they see for the future once the pandemic is brought under control.

The webinar, titled “Hospitality Hotline,” was sponsored by Bisnow, the world’s leading B2B platform serving the commercial real estate industry. The panel discussed the trials and tribulations on a local as well as a global perspective. The panelists included: Ashley Lin, director of development and acquisitions for Virgin Hotels; Vijay Dandapani, president and CEO for the Hotel Association of New York City; Matt Livian, chief investment officer at the Sydell Group: Rani Gharbie, head of acquisitions and development for The Pod Hotels: Chris Fernandes, director at HVS, and Mr. Wolfe, the moderator.

It’s no secret: New York Hospitality took it on the chin.

Opening the discussion, Mr. Wolfe invited the panelists to talk about their experiences during COVID and how their firms and their properties or clients have weathered it, as well as the present state of affairs and their outlook for the future.

Beginning in the local New York market, Mr. Dandapani of the Hotel Association of New York City, which represents 300 hotels in the city, acknowledged some of the difficulties his members experienced in the very tough environment. Looking back one year ago, he described the real panic from both city and state governments when COVID restrictions first took place in March 2020. “As many know, there are roughly 200 hotels that are temporarily closed as well as some prominent ones, like the Roosevelt, the Omni Berkshire, and the Maxwell, that have closed permanently. There could be others that close because what’s currently a cash flow liquidity problem has now become a solvency problem for some,” he said.

Stepping up in a time of need.

Even so, many Hotel Association of New York City members were pitched in and helped the city’s emergency services homeless shelter problem, with nameplates like Hilton Garden Inn and Marriott Courtyard participating.

“We helped the city’s administration procure hotel rooms pro bono,” Mr. Dandapani said, adding that a big team effort that is still ongoing and has been extended to June 2021. “It was supposed to end in October of 2020 but it probably won’t end till the end of this year just because of the slow vaccination roll-up that we’ve had.”

Mr. Dandapani asserted that his association’s job is to ensure a hospitable environment for the developers, owners, and operators that are in the city. “My job, and our job, is to ensure that the legislative environment and the regulatory environment are not in any way inimical to the city’s comeback, or at least minimize that effect. But, yes, there will be some attrition. We don’t know if it’s 15%, 20%, or even 25% of hotels that could repurpose particularly outside of Manhattan. But look, I’ve been here for three decades in New York, and hotels come and go, or get replaced, converted, adapted, reused, whatever. So we’ll see some of that again.”

In spite of the attrition, he said he fully expected what were formerly vibrant hotels to return to vibrancy very soon in the near term.

Expecting improvement in the near term.

Sharing Mr. Dandapani’s guarded optimism is Rani Gharbie, who oversees development and acquisition for the micro-hotel brand Pod Hotels, which is the second-largest owner-operator of independent hotels in New York, with properties such as The Greenwich, The Bowery, The Ludlow, and large properties like the Wellington, the Elysium, among others. Mr. Gharbie said his company is gearing up to grow exponentially over the next decade, and that his group is “long” on New York.

“We may seem that we’re ending up on the not-so-positive note, but the reality is that 2021, in my opinion, is a year for serious optimism. Maybe it’s not the recovery year, but it’s certainly a launch pad to recovery on many fronts,” he said, not dispelling the notion that some help may be needed to enable a more robust recovery. “We’re going to see the relationships between stakeholders on the real estate investments side calming down a little bit because of the green shoots of optimism lying ahead.”

Finding common ground with hotel regulators.

Mr. Gharbie expressed his support for a legislative regulatory framework to support the hospitality space in terms of bankruptcy moratoriums, guidance on forbearance, and other issues moving forward for a little longer than initially expected. “Long term, New York is New York. There’s absolutely no reason for its fundamentals, from a demand perspective, to be shaken because of a temporary pandemic,” he proclaimed.

Looking ahead, Mr. Gharbie said he believes people will be ready to go and start traveling again fiercely on the leisure side. Revenge travel, he called it. He expects the corporate travel side to be a bit more sensitive which might take it a bit longer to come back to where it was pre-pandemic. “We think conferences will probably be the slowest to recover.”

The hotel scene outside of New York? Less pain, sooner gain.

Ms. Lin, the director of development and acquisitions for Virgin Hotels, a 4.5-star lifestyle brand under Richard Branson’s Virgin Group, has a portfolio spanning the Americas and Europe, including properties in Chicago, Dallas and Nashville, with new properties to come in Las Vegas, New Orleans and New York City. Most of Virgin’s properties have been fully open since July. So in terms of the company looking forward, Ms. Lin says there’s definitely a light at the end of the tunnel with more indicators helping future operating decisions.

“Along the way we’ve had to make certain reducements in terms of labor burden, things like that, and really measuring how we come back from this,” Ms. Lin said. “But otherwise, we remain really hopeful in terms of demand, especially in southern cities like Dallas and Nashville. We’ve had really great success in terms of paring rooms with experiences while following COVID safety.”

Ms. Lin described how delaying new openings showed foresight as demand was boosted by waiting two or three months longer and avoiding disruptive stay-at-home orders. For example, Virgin plans on opening the Las Vegas property at the end of March 2021, coinciding with the governor mentioning the phased easement of COVID restrictions.

In the next four to five years she projects phased growth for the branded management company and selective owner-operator of Virgin properties.

Hotels turn the corner from COVID.

As managing partner and chief investment officer of Sydell Group, an owner, developer and operator of lifestyle hotels across the country and London, Matt Livian said his company looks for opportunistic places that the traditional brands have not. During the early days of COVID, his company’s properties were operating for the most part in a low occupancy environment, trying to be efficient, consolidating positions where possible, and being extremely grateful for his team members that came back and worked day in day out, under challenging conditions.

“There’s now a happier answer to the question than there was back in last April or May. Today, with the exception of our hotels in downtown Los Angeles and London (which was in lockdown the date of the webinar), all of our hotels are reopened,” he said, further explaining that it is hard to paint with a broad brush as all of the markets behaved a little differently. “Palm Springs, which is a drive-to leisure market, did better than the year before, but that was definitely the exception rather than the rule in our portfolio.”

Mr. Livian noted that the reality for New York will be tough in the short term; taking into consideration that prior to COVID New York already had several years of relatively flat to slightly down RevPAR growth, while expenses were growing above inflation. “I think people would be surprised at the number of hotels in New York that in 2019 either generated very little or negative NOI. New York has been hit, and a lot of the people who work in the big office buildings in New York haven’t come back in full force yet,” he said, adding that until the corporate base comes back to New York, it’s going to be hard to get pricing power on leisure travelers because there is no base business on the book.

The good news is: optimism is not in short supply at Sydell Group. Mr. Livian definitely sees better days ahead: “We know by the people who are coming to our hotels that, I think, the thirst for experience and travel is as strong as it’s ever been. And there is so much pent-up demand out there that once we get to the other side of this health crisis, we are optimistic. I’m looking forward to the day when our properties are back at full steam.”

Looking forward with optimism

Ashley Lin of Virgin said her company is anticipating luxury leisure travel to make up a large percentage of demand in the coming 12 months. “Our properties are experiencing a good amount of demand now and we expect the same in the future due to our amenities like pools, outdoor space programming and suites as they come back online.” Virgin’s present positioning in southern cities helps as these locations are more open in terms of more relaxed restrictions and social gathering. “We’re seeing smaller meetings with blocks between 25 to 50 rooms. But they’re really short in terms of booking, actually booking within the month for that month.”

Measuring value when times are tough and data lacking.

As a director with HVS, the global hospitality consulting firm, Chris Fernandes and his team remain solely focused on the entire lifecycle of traditional hotel and hospitality assets. This task became significantly more difficult once COVID arrived. “The majority of what we’ve been working on is helping folks understand where their value sits today, or I should say, over the past six months. It’s just been really unclear. As consultants and appraisers we always try to follow the data, and unfortunately, in this instance, there have never been fewer facts or less data to rely on.”

Predicting the unpredictable is always a challenge, particularly in the case of COVID-19 which for many months continued to grow in spread and severity. “When it first started the feeling was, okay, by the fall we’ll start to see some sort of return to normalcy. After that it was by the start of 2021. Nevertheless, now more than ever we have real hope to be optimistic that we’re rounding the corner here.”

Mr. Fernandes and his group are looking to late Q3 to Q4 when the recovery really starts to pick up particularly with the good news on the vaccine front. “I think that as that rollout plan really starts to come to fruition, and we start to see more confidence, that we’ll actually be getting back to some normalcy, which means we start to see folks really look forward to traveling later on this year, and that’s going to translate into a return in demand for New York City.

There’s never been a better time to challenge Pre-COVID property tax assessments

As the moderator and an attorney specializing in hotel and commercial property tax appeals, David Wolfe welcomed the news that Vijay Dandapani and the Hotel Association of New York City had launched a campaign decrying rental property taxes, assessed values, and the punitive 18% interest rate that New York City has not relented on collecting.

“We do a significant amount with institutions, trying to help them understand what their property tax burden may be post-acquisition, post-development, or in terms of post revaluation or reassessment risk,” Wolfe said. “So we’re very focused on one line item of the entire portfolio. There’s a huge focus, obviously, on property tax appeals as revenues are down significantly and jurisdictions are not necessarily reducing their property taxes accordingly in light of COVID.”

Supply shortages in the offing hold promise for survivors.

Wolfe turned the discussion towards talk about the potential for a loss of some supply in New York and how hotels are positioned for the next 6-12 months, as well as two and three years down the road, and beyond.

Mr. Dandapani confirmed that there’s definitely going to be a loss of inventory, noting that the Department of Citywide Planning thinks there’ll be a 30,000-room shortage in 2030 or thereabouts. “That’s only nine years from now. Between attrition and difficult regulatory hurdles to acquiring the necessary permits, the properties that survive are going to come out on the other side in great shape.”

Ms. Lin said she has seen an influx in inquiries regarding the New York market, especially from people that haven’t invested in hospitality before. “I don’t think that there’s a lack of demand or hope for optimism in New York. I really think that if you’re willing to wait a few years in terms of bringing it back to full demand and seeing how everything shakes out in terms of the supply, I think there are really pointed indicators in terms of New York really coming back full force.”

When the crowds return, New York City hotels will be ready.

While the near-term will be difficult, the consensus shared by the panelists is that the New York hotel market will definitely rebound in the next few years. This process can be accelerated if all the stakeholders come together – owners, government, labor, industry, etc. – all of the contributors who can have a direct bearing on helping hotel properties not only survive through this pandemic, but thrive on the other side.

Hotel owners also need to look for every opportunity to save on expenses while maintaining their service. Property tax is one area where a data-driven approach can be taken to lower costs and increase value. If jurisdictions are showing little inclination to reduce their property taxes accordingly in light of the COVID-driven downturn, a property tax appeal guided by an experienced attorney such as Mr. Wolfe might be able to save a hotel owner millions of dollars in assessments.

A property tax appeal can help get your hotel back on its feet faster. Learn how…

Mr. Wolfe’s firm, Skoloff & Wolfe, P.C., has obtained billions of dollars in assessment reductions for clients and property owners in multiple industries, including hospitality. Results may vary depending on your particular facts and legal circumstances. At the time of the webinar, Mr. Wolfe had appeals pending from New York City to Hawaii to Florida. To have a conversation with a property tax appeal attorney, give Skoloff & Wolfe a call at (973) 992-0900.