In Township of West Milford v. Van Decker (120 N.J. 354 576 A.2d 881), the New Jersey Supreme Court ruled in favor of the defendants who it said were singled out for property tax reassessment after purchasing a new home in the municipality. Argued and won by the property tax attorneys at Skoloff & Wolfe,… Read more »

Tag: nj property tax appeal lawyers

NJ Municipalities are Targeting Commercial Property Owners for Property Tax Increase

A growing number of municipalities in New Jersey are suing commercial property owners to increase property tax assessments. Commercial property tax reverse appeals are among the most significant and controversial issues that pose the greatest potential risk for buyers and owners of commercial property in the Garden State. Whether driven by external counsel motivated by… Read more »

David Wolfe, Esq., Skoloff & Wolfe, P.C. property tax attorney, speaks on the future of real estate on the waterfront

On June 30, 2021, David Wolfe, property tax appeal attorney, joined as a panelist at Bisnow’s Digital Summit: Development, Investment and Industry Growth to discuss the future of the real estate office market in the New Jersey waterfront area. Panelists included Michael Goldstein, Managing Director of KABR, Mark Ravesloot, Vice-Chairman of CBRE’s Midtown Manhattan office,… Read more »

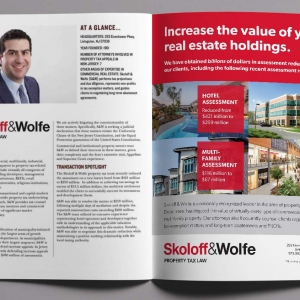

Skoloff & Wolfe, P.C. Recognized on NJ’s Best Commercial Property Tax Appeal Law Firm List

Real Estate NJ, the commercial real estate voice of New Jersey, recently featured Skoloff & Wolfe, P.C. (S&W) in its “NJ’s Best Property Tax Appeal Law Firms” list. Please note that no aspect of advertisements or any other accolade listed have been approved by the Supreme Court of New Jersey. Learn more about the standard… Read more »

The Impact of COVID-19 on 2021 Property Tax Assessments

David Wolfe, Skoloff & Wolfe, P.C. co-managing partner, recently was a guest on The Morning Spotlight, a new podcast that tackles hot topics in the NJ real estate industry. The conversation centered on subjects relevant to commercial property owners in the age of COVID-19, such as being prepared with an action plan and experienced legal… Read more »

David B. Wolfe, Esq., NJ Property Tax Attorney, Recognized as 2020 ROI Influencer in Real Estate

ROI-NJ, a media company that informs and connects businesses in New Jersey, announced that David B. Wolfe, co-managing partner of Skoloff & Wolfe, P.C. (“S&W”), was selected to its list of 2020 influencers. Please note that no aspect of advertisements or any other accolade listed have been approved by the Supreme Court of New Jersey…. Read more »

How Golf Courses Can Ace Their Property Tax Appeals

By David Wolfe, Co-Managing Partner, and Vincent Ferrer, Associate, at Skoloff & Wolfe, P.C. (Livingston, N.J.) For golf courses and country clubs, property taxes can end up being one of their largest annual expenses. Many have begun considering a challenge to their tax assessments, especially now—in the age of COVID—when revenue from events, member fees,… Read more »

In 2021, A Looming Threat for Multifamily Investors

As tumultuous as 2020 has been, 2021 may be even worse for many multifamily real estate owners and investors. “Property owners need to be aware that in addition to taxes going up [in 2021], they can be sued by municipalities,” said David Wolfe, Esq. during CAPRE’s Multifamily Leadership Roundtable on Thursday, October 29, 2020. The… Read more »

David Wolfe, Esq. Moderates National Panel on Multifamily Real Estate Investment at CAPRE’s 2021 Multifamily Leadership Roundtable

Pandemics. Politics. Profits. The year 2020 has seen chaos caused by all three. And on Thursday, October 29, 2020, professionals in the multifamily real estate industry came together to weigh in on just how impactful these will be in 2021. David Wolfe, Esq., served as moderator for the nationally-broadcasted panel “Capital Markets for Multifamily: Debt,… Read more »

Skoloff & Wolfe, P.C. Property Tax Appeal Practice Supports 2020 March of Dimes Real Estate Awards Program

Despite the coronavirus pandemic, the March of Dimes is continuing to lead the fight for the health of all moms and babies by funding research, leading programs, and providing education and advocacy. A key part of supporting this mission is events like the Real Estate Awards Reception, which was held on September 24 as a… Read more »