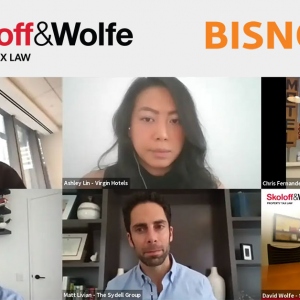

David Wolfe, Esq., co-managing partner of Skoloff & Wolfe, P.C., in February hosted six leaders in the hospitality space for a discussion about the current state of affairs in the hotel business in the age of COVID, and importantly what they see for the future once the pandemic is brought under control. The webinar, titled… Read more »