Newark, New Jersey, has been ordered to complete a municipal-wide revaluation of all real estate, including commercial, multifamily, and industrial properties. The revaluation is scheduled for 2027, but inspectors are conducting inspections, and the revaluation is moving full steam ahead.

As Newark undergoes its revaluation, many commercial property owners, especially those who remember the sharp impact of the 2013 revaluation, are understandably concerned. However, based on analysis of recent revaluations in large urban municipalities and statewide, the upcoming revaluation may be significantly less disruptive than feared. Of course, while there is always risk, and there are no certainties when it comes to property taxes, there is room for optimism that things will be better than they were in 2013.

A Look Back at the 2013 Newark Revaluation

In 2013, the Newark revaluation resulted in a dramatic shift of the property tax burden onto commercial taxpayers. The combination of (i) the decline of residential property values following the 2008 housing crash and (ii) the significant appreciation in the value of Class IV properties (commercial, industrial, hotel, and multifamily buildings) resulted in a major tax increase for Class IV taxpayers.

“In an appreciating market environment, we typically see reductions in the general and effective tax rates in revaluations,” explains David Wolfe, Co-Managing Partner at Skoloff & Wolfe, P.C.

“However, in 2013, due to a significant decline in the effective total ratable base, there was a dramatic increase in the effective rate (which is the general tax rate x equalization ratio). As a result, when commercial property owners’ assessments were increased, they experienced outsized increases in their taxes, some increasing by more than 100%.”

Projections for the Current Newark Revaluation

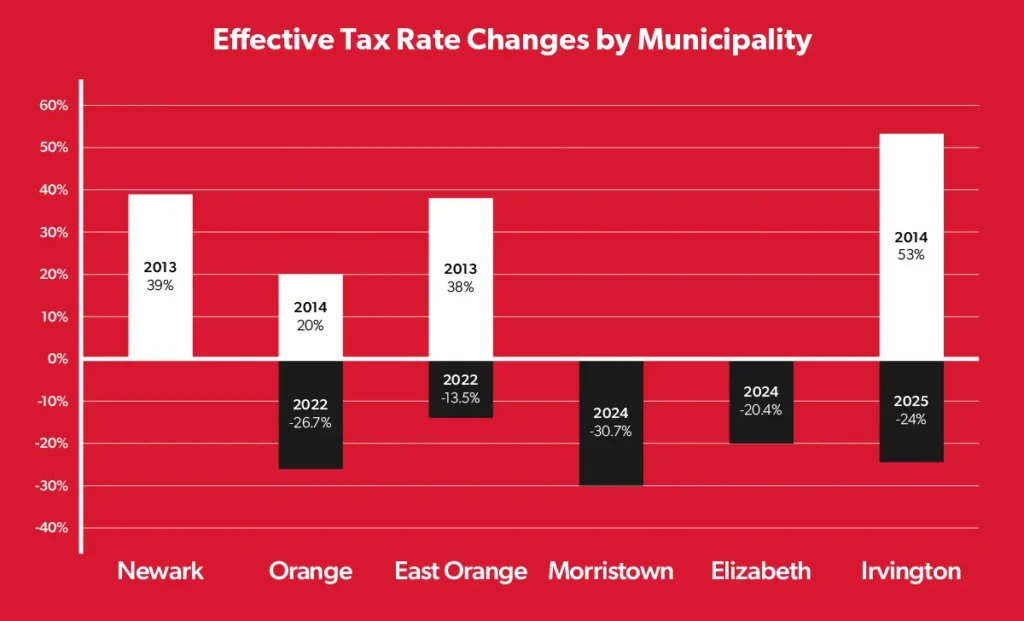

In recent years, there has been a clear pattern of effective tax rates declining following revaluations, which provides grounds for optimism for the Newark revaluation. This has particularly been the case in large urban municipalities in Northern New Jersey, where effective tax rates have declined dramatically in recent years, unlike in the years following the 2008 crash.

The chart below compares the percentage changes in effective tax rates in Orange, East Orange, Morristown, Elizabeth, and Irvington. On average, these municipalities’ effective tax rates increased by 37.5% in their 2013 and 2014 revaluations. In comparison, in recent years, these municipalities averaged reductions in their effective tax rates of 23.06%.

In addition, this trend is not unique to large municipalities. Skoloff & Wolfe, P.C., has compiled data from municipalities across New Jersey that have undergone revaluations in the past 3–4 years. In virtually 100% of those cases, effective tax rates have decreased, often by 15–20%. These reductions are especially pronounced in municipalities that have not undergone a revaluation in more than ten years, and the equalization ratios are low. Newark fits well into this category.

A Revaluation’s Impact on the Market

Revaluations create uncertainty, which can impact the market’s ability to function. This pause is understandable. Property taxes are often the largest single line-item expense on a commercial property’s financials, and uncertainty about post-reval taxes makes it difficult to confidently project net operating income (NOI) and inserts additional risk into the equation.

However, with the right information, there may be opportunities for savvy investors. Understanding historical trends in tax rates and projecting assessments can help buyers and sellers navigate this uncertainty. In some cases, buyers may be able to negotiate favorable pricing, and sellers may be able to demonstrate that the revaluation may not be as financially perilous as otherwise imagined.

Property Owners Need Informed Advice

While we do not expect the same kind of tax burden shift that shocked the commercial real estate market a decade ago, these trends may not necessarily continue. Moreover, each individual owner must be prepared to address the risks associated with the revaluation. If you are a commercial property owner or property manager in Newark or the surrounding areas, now is the time to engage advisors who understand the revaluation process and can help make strategic decisions.

Contact us to review your commercial real estate holdings and potential for a property tax appeal.

Skoloff & Wolfe, P.C., is well-versed in the area of property tax law. The Tax Department has litigated the value of virtually every type of commercial, industrial, and multi-family property. Our attorneys also frequently counsel clients regarding property tax exemption matters, long-term abatements, PILOTs, transfer taxes, and Non-Residential Development Fees (NRDF). Our clients include developers, management companies, financial institutions, REITs, hospitals, universities, religious institutions, private equity firms, and insurance companies.