Earlier this year, as part of Governor Murphy’s 2025-2026 budget, Jersey City’s school district experienced the biggest reduction in state aid among all districts in New Jersey, losing $4 million of state funding. This represents approximately a 3% decrease in state support for the City’s schools.

When the school funding decrease was announced, we advised Jersey City taxpayers to brace for a potential rise in property taxes. Now that Jersey City has published its estimated third-quarter tax rate, it is evident that the increase may be even more significant than originally anticipated.

Jersey City’s third quarter estimated tax rate is 2.338%, representing a 4.7% increase over the final 2024 tax rate. “Unfortunately, it appears that commercial taxpayers must be prepared to pay increased taxes in Jersey City this year,” said David B. Wolfe, Managing Partner at Skoloff & Wolfe, P.C. Additionally, it is possible that the final rate will exceed the third quarter estimate. “Historically, we have seen that the increase in the third quarter estimate can represent only a fraction of the final increase. For example, in 2022, the initial third quarter increase was 18%, but the final increase nearly doubled to 32%.”

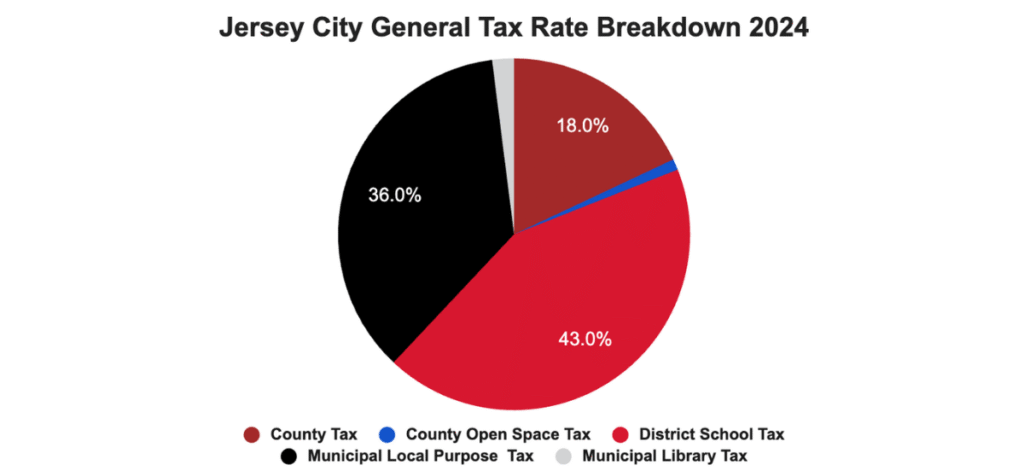

The 2025 increase appears to be driven primarily by the Jersey City Board of Education’s final $1.03 billion budget, which is projected to increase the tax levy by between 16% and 20%. If the District continues to see a decline in its state aid, barring alternate sources of revenue, there will also continue to be ongoing pressure on the tax rate in future years, as the school tax represents approximately 43% of the tax rate in Jersey City as follows:

Not included in 2024 City Taxes (0%): Library Tax, Health Service Tax, Reg. Consol. & Joint School Tax, Local School Tax, and Municipal Open Space Tax.

Jersey City taxpayers have endured steep property tax increases in recent years. In 2022, Jersey City’s property taxes rose by 32%, and in 2023, they climbed another 6%. The City was able to hold the line in 2024, and the rate actually declined by 0.6%.

“Unfortunately, we are now estimating an increase in the final 2025 tax rate somewhere between 5% to 10%,” advises Mr. Wolfe. “However, the rate could exceed that range, and we are recommending that our clients be prepared to pay significantly more taxes than they did last year.”

In this fiscal climate, it is more crucial than ever that taxpayers ensure they are not paying more than their fair share of the property tax burden. Skoloff & Wolfe, P.C. has reduced clients’ assessments in Jersey City by billions of dollars, resulting in substantial savings and helping mitigate the extraordinary increase in the City’s tax rates.* The firm continues to contest assessments throughout the City and works with clients annually to ensure that meritorious appeals are identified and prosecuted efficiently.

Contact us to review your Jersey City real estate holdings and to discuss the potential for a property tax appeal.

Skoloff & Wolfe, P.C., is well-versed in the area of property tax law. The Tax Department has litigated the value of virtually every type of commercial, industrial, and multi-family property. Our attorneys also frequently counsel clients regarding property tax exemption matters, long-term abatements, PILOTs, transfer taxes, and Non-Residential Development Fees (NRDF). Our clients include developers, management companies, financial institutions, REITs, hospitals, universities, religious institutions, private equity firms, and insurance companies.

*Results may vary depending on your particular facts and legal circumstances.