When Governor Murphy revealed his 2025-2026 budget, the school aid funding for Jersey City received the largest dollar decrease of any district in New Jersey. The district will lose $4M, which represents a 3% decline in state funding for the City. This continues the long-term trend of declining state funding for Jersey City Public Schools.

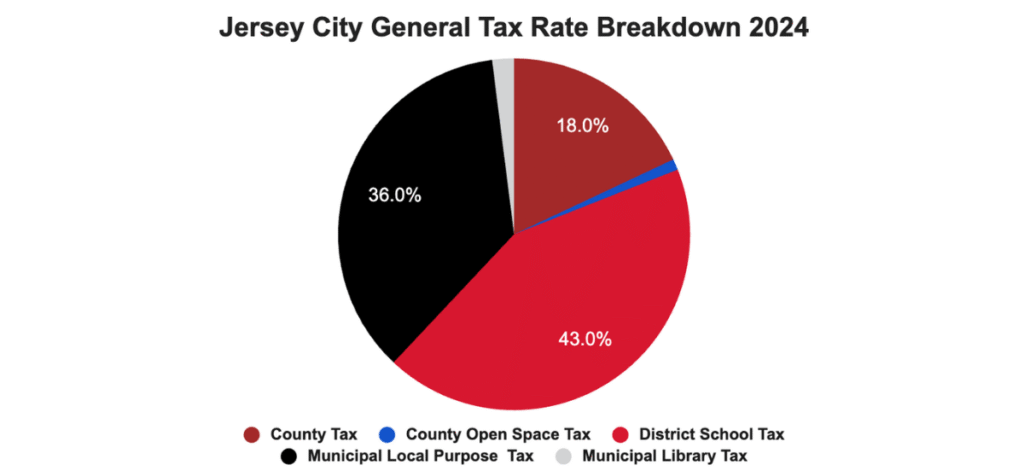

For Jersey City commercial property taxpayers, depending on the final school budget, this could mean a material increase in the 2025 tax rate. If this trend continues, barring alternate sources of revenue, there will be ongoing upward pressure on the general tax rate in future years as the schools represent approximately 43% of the tax rate in Jersey City, as follows:

Not included in 2024 City Taxes (0%): Library Tax, Health Service Tax, Reg. Consol. & Joint School Tax, Local School Tax, and Municipal Open Space Tax.

Jersey City taxpayers have endured steep property tax increases in recent years. In 2022, Jersey City saw a 32% increase in its property taxes and a 6% increase in 2023. However, the City was able to essentially hold the line in 2024, and the rate actually declined by .6 percent.

“Unfortunately, given the decline in State Aid, and projected increase in the school budget, we are recommending Jersey City taxpayers budget for a 3-5% increase in their commercial property taxes in 2025,” said David Wolfe, Co-Managing Partner of Skoloff & Wolfe, P.C. “While we commend the city for not increasing taxes in 2024, this anticipated increase further compounds the almost 40% increase experienced by taxpayers in Jersey City in recent years.”

At the present time, the Board is still projecting that it will only increase its tax levy by 2%. However, the Jersey City BOE is expected to hold its next budget hearing on April 30th to continue to address these items.

“We are appealing property taxes on significant commercial properties throughout the city,” said Mr. Wolfe. “Further tax increases jeopardize the financial success and viability of these properties and make property tax appeals even more urgent. It is our hope that the BOE and City will continue to operate in a responsible and sustainable approach and that any tax increase for 2025 will be within the 2% limit.”

Skoloff & Wolfe, P.C. is currently advising many of the largest taxpayers in Jersey City and the Gold Coast involved in building, buying, selling, or operating property.

Contact us to review your Jersey City real estate holdings and to discuss the potential for a property tax appeal.

Skoloff & Wolfe, P.C. is well-versed in the area of property tax law. The Tax Department has litigated the value of virtually every type of commercial, industrial, and multi-family property. Our attorneys also frequently counsel clients regarding property tax exemption matters, long-term abatements, PILOTs, transfer taxes, and Non-Residential Development Fees (NRDF). Our clients include developers, management companies, financial institutions, REITs, hospitals, universities, religious institutions, private equity firms, and insurance companies.