When it comes to property tax assessments, most commercial property owners in New Jersey focus on one number, the assessed value. But there is another often overlooked figure that can have a major impact on your tax burden: the equalization ratio.

This “silent component” of property tax appeals can determine whether you are paying your fair share, or significantly more than you should be.

What Is an Equalization Ratio?

In New Jersey, each municipality has an equalization ratio, which represents the average relationship between assessed value and true market value for all real property in that taxing district.

In simple terms, it is the percentage at which the municipality is theoretically assessing property compared to its real market value.

For example:

If your property is assessed at $50 million in a town with an equalization ratio of 50%, your equalized (or implied market) value is $100 million ($50 million ÷ 0.50).

So, the lower the equalization ratio, the higher your property’s implied market value becomes for tax purposes.

Why Equalization Ratios Exist

Most municipalities in New Jersey do not reassess properties annually. When a revaluation occurs, assessments are theoretically set at 100% of market value for that year.

However, as the market changes over time and property values rise or fall, those assessments become outdated.

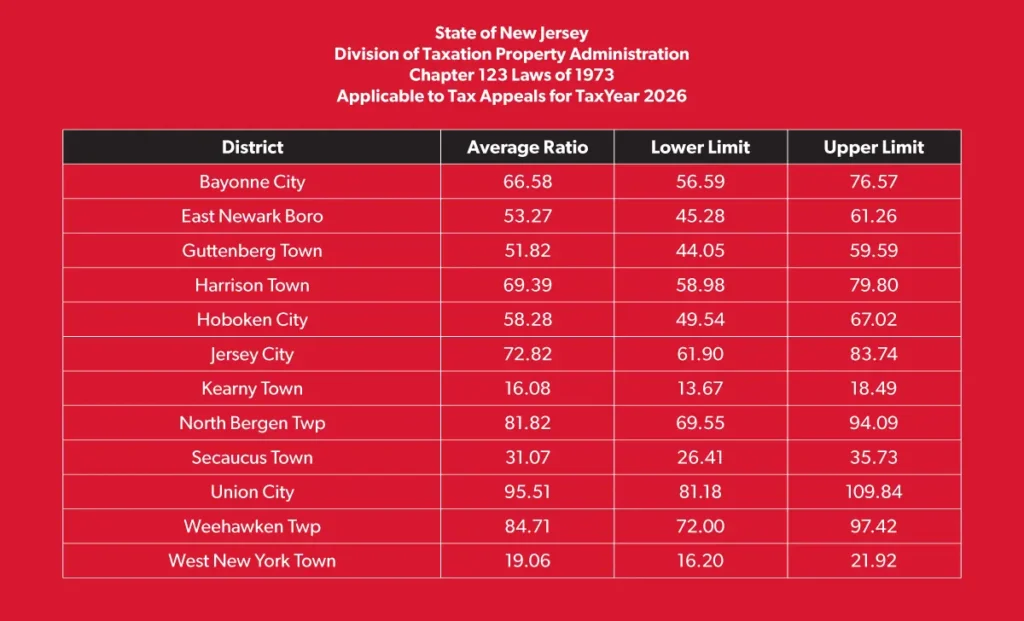

To address this for purposes of County Equalization, the New Jersey Division of Taxation calculates and publishes an equalization ratio each year (as of October 1) for every municipality. This ratio allows for the equal distribution of the county tax burden amongst municipalities. For taxpayers, it enables them to understand the implied value of their assessments and challenge them, even if no new revaluation has taken place.

How the Ratio Is Calculated

The equalization ratio is determined annually through a study conducted by the Division of Taxation. It compares recent property sales and their assessments to estimate the relationship between assessed values and market values within each municipality. After excluding certain sales and weighting the transactions, the resulting percentage is determined to be the average equalization ratio for a particular year.

Why It Matters for Commercial Property Owners

Unfortunately, many taxpayers never think about the equalization ratio. However, without understanding the ratio, taxpayers will not be able to know if their property is over-assessed and potentially overtaxed.

For example, suppose a commercial property in Jersey City was assessed at $100 million during a revaluation, and that figure accurately reflected its value at the time. Using the chart* below, which shows the current equalization values for Jersey City in 2026, the equalized value of the property has now grown to be in excess of $137 million.

Jersey City’s equalization ratio has dropped to 72.82%. Determine the new implied (equalized) value by dividing the assessment by the ratio:

$100,000,000 ÷ 0.7282 = $137,300,000

That means the property is being taxed as though it is now worth $137 million, even though the market may not support that value.

Without knowing the current equalization ratio, you might never realize that your property may be a strong candidate for a tax appeal.

The “Silent” Factor in Appeals

Because municipalities are not required to notify taxpayers of the municipality’s equalization ratios, many commercial property owners simply continue paying taxes on outdated assessments, unaware that a declining ratio may indicate that their property is over-assessed.

“It is a ‘silent component’ of tax appeals,” explains David Wolfe, Co-Managing Partner at Skoloff & Wolfe, P.C. “One of the biggest challenges for property owners is that equalization ratios are not automatically provided on annual assessment notices, so if you do not know what your equalization ratio is, you do not know whether or not you have a potentially meritorious case for appeal.”

Jersey City: A Case Study in Declining Ratios

Jersey City is a prime example of why equalization ratios matter. Over the past several years, the city’s ratio has declined sharply, meaning that properties whose assessments were set during the last revaluation are now paying taxes as though their properties have appreciated dramatically.

For commercial property owners, this decline in the ratio dramatically increases the likelihood of a meritorious tax appeal. Even if you filed and won a property tax appeal just two or three years ago, it is possible that property is now materially over-assessed. Reviewing your property’s assessment in light of the most recent ratio could uncover meaningful savings.**

What Property Owners Should Do

Commercial property owners in New Jersey should check their municipality’s equalization ratio each year and consult with a property tax attorney to determine whether their properties may benefit from property tax appeals.

Experienced Counsel for New Jersey Commercial Property Tax Appeals

If you believe your commercial property may be over-assessed, the Tax Department at Skoloff & Wolfe, P.C., can help. Our firm advises many of New Jersey’s largest real estate taxpayers in commercial property tax appeals, litigating the value of virtually every type of commercial, industrial, and multi-family property. Our attorneys also frequently counsel clients regarding property tax exemption matters, long-term abatements, PILOTs, transfer taxes, and Non-Residential Development Fees (NRDF).

Contact Skoloff & Wolfe, P.C. to discuss your New Jersey commercial property tax appeal and learn how our experience can help you identify opportunities for meaningful tax savings.**

*https://www.nj.gov/treasury/taxation/lpt/statdata.shtml

**Client results may vary depending on facts and legal circumstances.